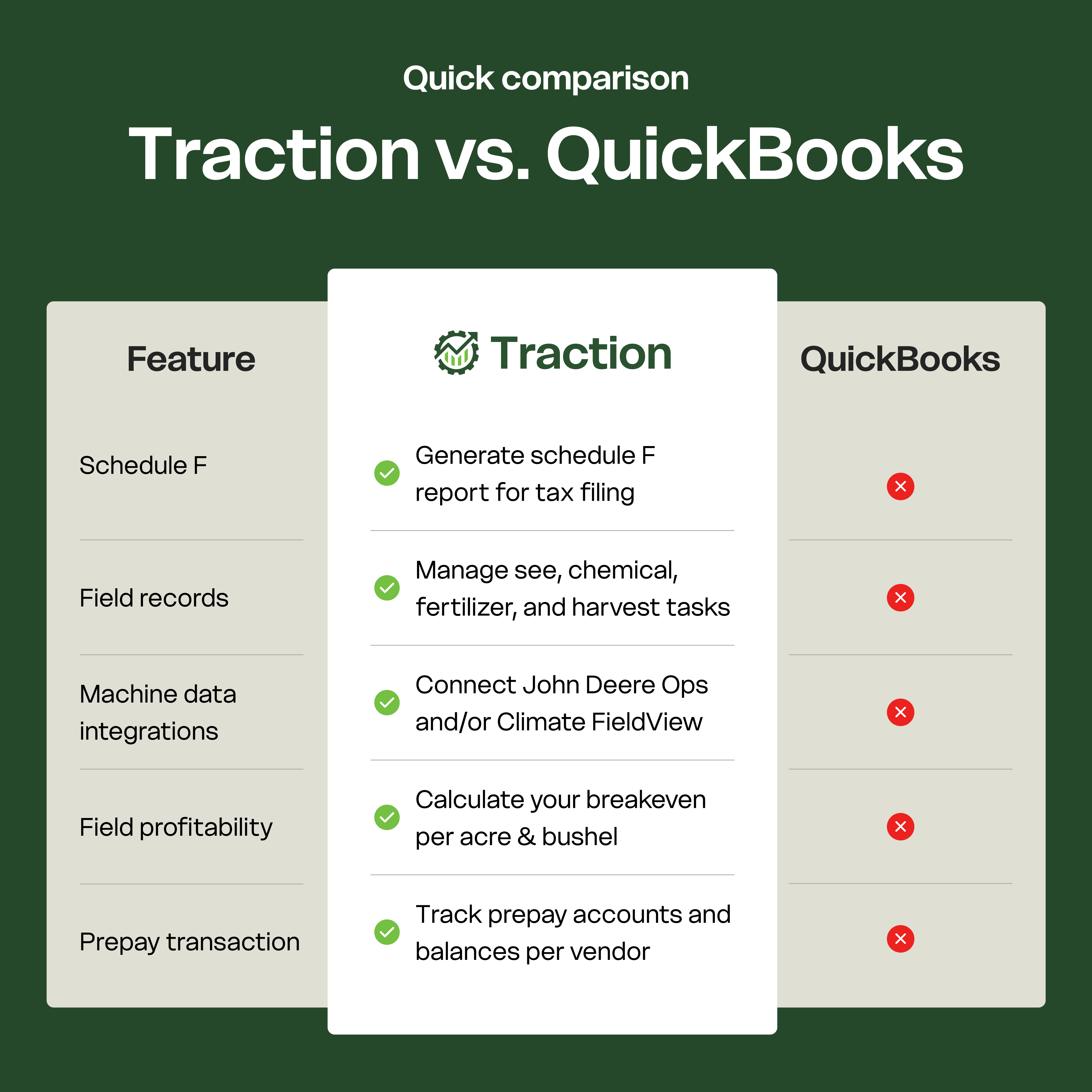

Traction Ag vs QuickBooks

Built just for farming with features QuickBooks can’t match. From entity tracking to crop-year reporting and much more.

See the difference with farm specific features

When stacked side by side, the choice is easy.

Features

Traction Ag

QuickBooks Online

Multiple entities, one subscription

Traction offers a simple solution for the complexity of your operation, allowing you to create an unlimited number of business entities without paying extra fees for each. Whether it is an additional trucking, land, livestock, equipment, or seed business you need to keep track of, we’ve got your back.

You donʼt want to pay a separate subscription for each of those entities like you have in QuickBooks. With Traction, it is as easy as hitting “Add Entity” and filling in the details of each entity. The real value comes as you generate reports, because you can quickly separate or combine your entities as needed.

"Traction makes it easy to tie my accounting numbers back to field, so I can clearly see my true cost per acre and bushel."

Input & grain inventory tracking

As a grower, you juggle everything from weather and markets to what’s in storage. Traction Ag gives you a real-time, accurate view of your supply. After harvest, enter records or pull them automatically, and your inventory updates instantly. You’ll always know how many bushels are left to sell.

Traction goes beyond basic inventory. You can search by product and see a full history of related operations and purchases, detail QuickBooks simply can’t match.

"Traction takes decision making to the next level by leveraging your true costs, available anytime at your fingertips — an industry game changer!"

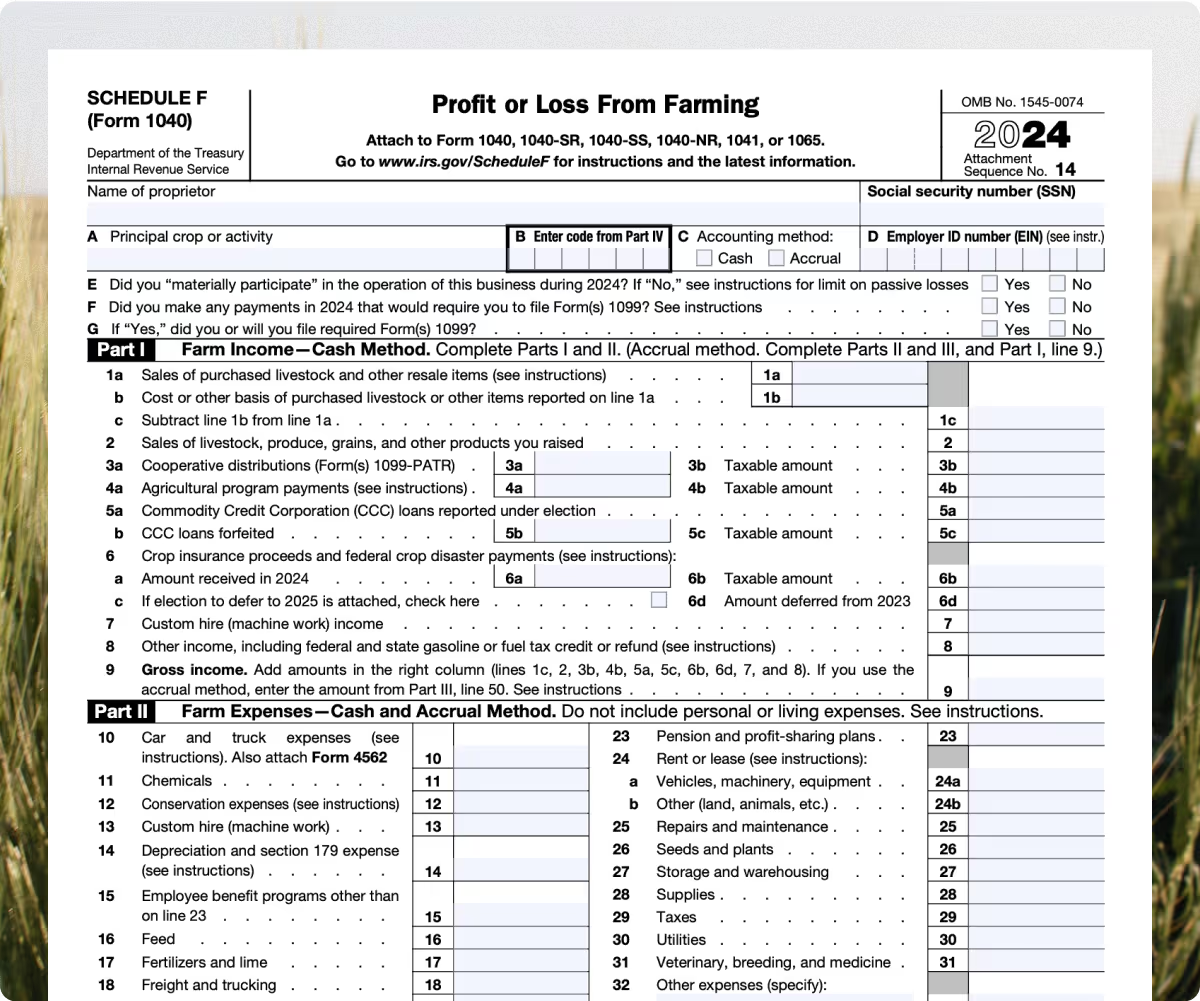

Cash & farm-based financial reporting

Generate a complete set of cash and accrual reports such as Schedule F, Field Profitability, and Market Value Balance Sheet for any number of entities. See what segments of your operation are truly generating a profit or loss.

Traction makes it easy to share key reports detailing items such as expenses and revenue with your Trusted Advisors. We know that time is money on the farm, and Trusted Advisors should be easily kept in the loop as you see fit.

"As the bookkeeper for the farm, I really appreciate how Traction simplifies billing and invoicing across all our entities. It’s made my workflow much smoother and more organized."

Schedule F

Unlike QuickBooks, Traction generates a Schedule F report quickly, saving time by automatically populating the necessary information.

This allows you to monitor your financial situation throughout the year, aiding in year-end purchasing decisions for tax purposes. The software keeps everything organized for you, your accountant, or tax preparer.

“I've connected JD, payroll, and FS to my Traction accounting platform which makes it easier having everything in one place for timely decisions.”

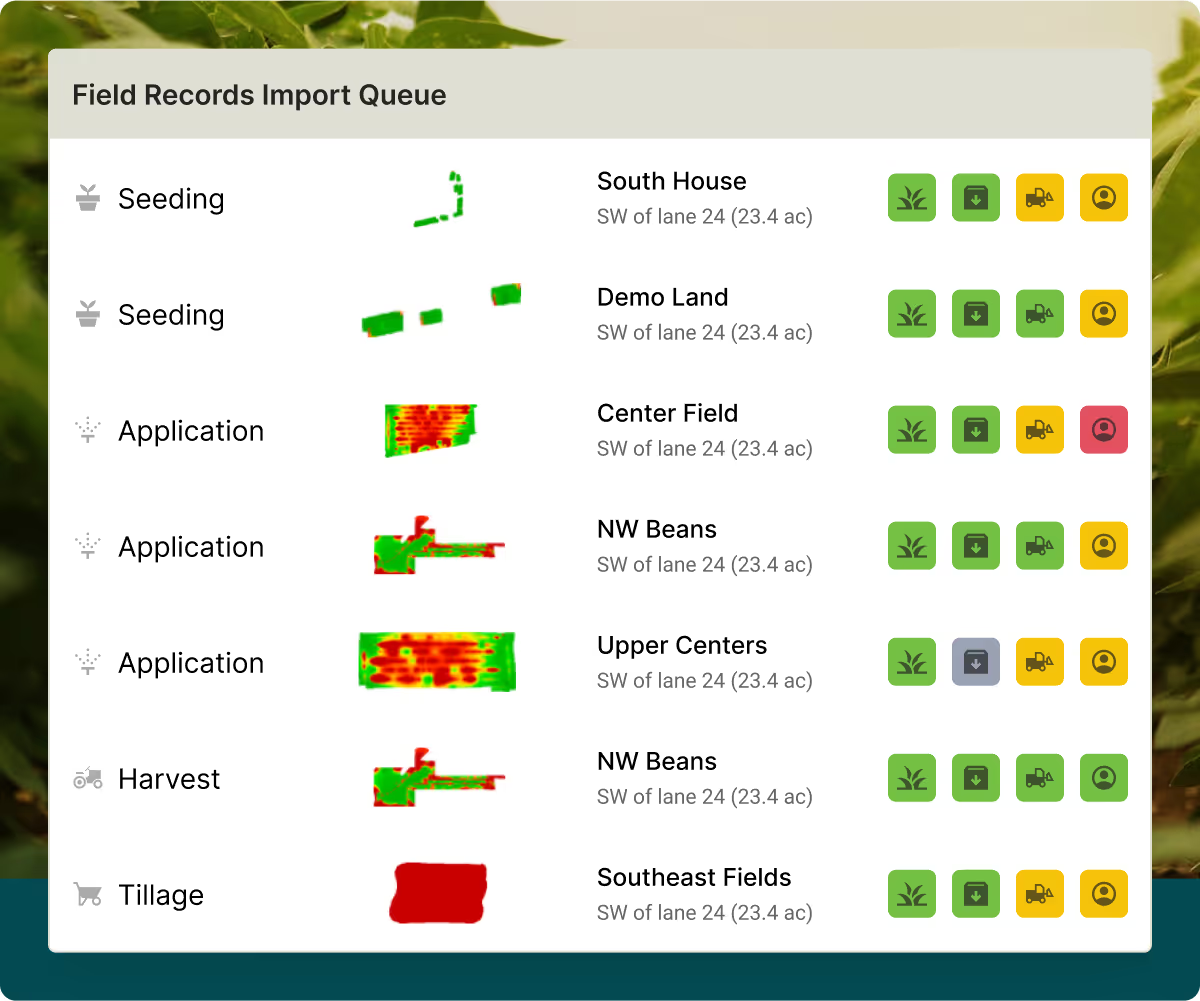

Field records

Protect your business with automated and precise activity records, ensuring you have solid data ready in case of an audit. Chemical spray drift poses significant risks, including fines and possible legal actions against growers accused of improper use. Addressing this risk goes beyond following application guidelines; it requires diligent and thorough recordkeeping to safeguard your crops, business, and your reputation.

Traction Ag tracks the wind speed and direction at the time of field applications, so you can count on full traceability whenever you need it. You might be tracking this in a spreadsheet today, but there’s an easier, more accurate, automated way.

“Traction gives farmers the tools they need to manage their operation day-to-day, and gives me exactly what I need for bookkeeping and tax prep—without workarounds or delays. It’s a seamless system that works for both sides.”

Invoicing

QuickBooks only allows farmers to handle general invoices. With Traction Ag, imagine having an invoicing tool that automatically calculates the landlordʼs share of inputs, based on your specific land agreement.

Simply start a new invoice and click directly on the particular land agreement. Traction will automatically pull in all of the products (with their associated costs) and the quantities the landowner is responsible for based on that agreement. So if the landlord is responsible for paying 40% of all fertilizer costs for a specific field, Traction will only pull in 40% of the total quantity used on the landownerʼs invoice. All this occurs with little manual input.

“When I’m setting up the vendor or the contact, I can click if they need a 1099 right away. Then come tax season, all I have to do is click a few buttons, and it’s there for me.”

John Deere Operations Center and/or Climate FieldView integrations

Easily connect yield and as-applied data from John Deere Operations Center or Climate FieldView™ for a unified farm view. Skip manual entry and get the insights you need with flexible integrations that work together or separately.

You know the price of a tractor, but what’s its true cost over time? QuickBooks makes that hard. With Traction Ag, assign machines to field records and see real costs on your Field Profit Center Report.

“One of the benefits we enjoy most is the John Deere Operations Center integration. It lets us tie product applications directly to our purchases, so we can see which enterprise is truly profitable.”

Profitability per acre & bushel

You can’t improve farm profitability without the right data. Traction lets you allocate expenses, revenue, products, equipment costs, and harvest details to specific fields for a clear breakeven per bushel.

With QuickBooks, seed costs get lumped together. In Traction, you track variety, units, and cost, and assign them to fields for accurate profit reports. Integrations with John Deere and Climate FieldView™ pull in records automatically, giving you a full picture of your operation (detail QuickBooks can’t provide).

"Our field records can be entered manually or linked with John Deere Operation Center for automatic syncing, integrating all data back to accounting — which is essential for us."

Prepay transactions

Your farm’s transactions aren’t like other businesses, your accounting software should reflect that. QuickBooks struggles with prepays, but Traction handles them with ease.Set up prepay accounts for seed, fertilizer, or chemicals.

Traction expenses them for the year, tracks balances, and offsets deliveries automatically. No more guessing what you paid months ago. It’s all there, ready to reconcile.

"The integration with FieldView gives us an easier way to manage inventory usage in Traction and helps with input projections for next year."

Chart of accounts

The Chart of Accounts in QuickBooks lets you create custom accounts like most accounting software.Traction gives you a set of common farm accounts ready to use, saving time on manual setup. These accounts are pre-configured for the Schedule F report, streamlining your process even more.

You can still create additional accounts beyond the pre-set options. The biggest advantage is that these accounts can be shared across entities, saving even more time.

"I love how farm-specific Traction is. I can categorize everything—repairs, chemical expenses, even down to seed and chemical types—without sorting through piles of receipts."

Data sharing

We know that Trusted Advisors surround every strong farming operation and we wouldn’t want it any other way. We believe that your accountant should have easy access to your financials free of charge if you want them to.

"The bank transaction syncing saves me countless hours and it has one of the easiest user interfaces that I've seen."

Farm- smart support

Experience first-class customer service right when you need it. We are a team of ag enthusiasts and farmers, so we know how important it is to get answers fast. You can connect with our knowledgeable support team any time of the year through channels such as live chat, email, phone, and virtual meetings.

Ag Data Transparent certified

We believe you should own your data.

Farm accounting that just works.

Tired of hacking workarounds in software that wasn’t built for farms? We made Traction Ag just for you.

Agape Farms in Ohio